The buy now, pay later (BNPL) sector in Vietnam once promised to transform digital finance — but by 2023, it faced a harsh reality. A string of startups, including Ree-Pay, Atome, and Kaypay, shut down after struggling to raise capital and manage risk amid tighter funding and rising defaults.

Still, some players endured. Fundiin, founded in 2019 by Nguyen Anh Cuong and Vo Hoang Nam, emerged as the leading survivor. By focusing on small and mid-sized retailers, strict risk control through eKYC and data algorithms, and avoiding cash lending, Fundiin has grown fivefold in partnerships and tripled its 2023 revenue. The company raised US$6.8 million from investors such as Genesia Ventures and aims to break even by late 2025.

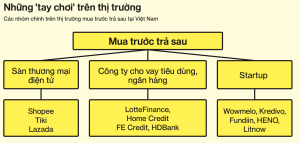

As foreign-backed rivals retreat, Vietnam’s BNPL market — forecast to grow at over 31% CAGR through 2028 — still holds promise. But as CEO Cuong notes, success now depends not just on growth, but on surviving the long “capital winter.”